Investor Deal Overview – Cash Only · As-Is

This page is for serious cash buyers. It shows the real liens, tax history, assessed value, and clear profit scenarios so you can decide quickly if this deal works for you.

Property, Ownership & Debt Timeline

Use: Single-family residence (Use Code 510)

Year Built: 1992

Square Footage: 1,427 sq ft (interior livable)

Bedrooms: 2

Bathrooms: 2.5 (2 full, 1 half)

Lot Size: 0.33 acres (approximately 14,375 sq ft)

Current County Snapshot (2024)

| Owner of Record | Financial Center First Credit Union (Sheriff's Deed) |

|---|---|

| Deed Type / Date | Sheriff's Deed · 12/03/2025 (sale date 08/19/2025) |

| Land Assessment | $27,900 |

| Improvements Assessment | $259,200 |

| Gross Assessment | $287,100 |

| Net Annual Tax (2024) | $3,244.92 |

| HOA Fees | $22/month (Shadow Pointe HOA) |

| Special Assessments | Varies; last was $240.00 (2024) |

Assessed values and tax history are from Marion County parcel records. Market resale after light rehab is expected to track above assessment, near the $300K–$315K range based on condition and layout.

Recorded Mortgages & Key Docs (Summary)

| Year | Doc Type | Doc No. | Parties / Consideration |

|---|---|---|---|

| 2025 | Sheriff Deed | A202500103198 | FINANCIAL CENTER FCU → takes title via sheriff's sale |

| 2022 | Mortgage | A202200076094 | Cody J Rice-Velasquez ↔ Financial Center FCU |

| 2020 | Mortgage | A202000094148 | Consideration ≈ $15,700 (2nd lien) |

| 2020 | Mortgage | A202000094154 | Consideration ≈ $125,600 (primary lien) |

| 2017 | Mortgage | A201700073231 | Consideration ≈ $133,536 (purchase money) |

Multiple mortgage refinances/releases have occurred; current working assumption for this deal: combined payoff of all active liens ≈ $221,142.66 (to be verified by title).

Financial Snapshot & Profit Scenarios

Inputs (Assumptions)

| Estimated lien + tax payoff | $221,142.66 |

|---|---|

| Buyer closing costs (title, fees) | $2,200.00 |

| Cash to seller at closing | $20,000.00 (ask) |

| Total acquisition cost | $243,342.66 |

| Light rehab budget | $10,000.00 |

| Total cost basis (all-in) | $253,342.66 |

Exit Scenarios (Flip / Wholetail)

| Scenario | Resale Price | Gross Profit (vs. Basis) |

Est. Selling Costs* | Net Profit |

|---|---|---|---|---|

| Conservative | $295,000 | $41,657 | ≈ $23,200 | $18,457 |

| Base Case | $305,000 | $51,657 | ≈ $23,800 | $27,857 |

| Optimistic | $315,000 | $61,657 | ≈ $24,400 | $37,257 |

*Selling costs assume ~6% agent commissions + ≈$2.5K resale closing + ≈$3K holding/interest. Adjust to your own capital and disposition model.

Profit Range Visual

This is a distressed-paper, as-is property with clear upside from basic rehab. If your buy box requires a specific % return, plug in your own numbers using the inputs above.

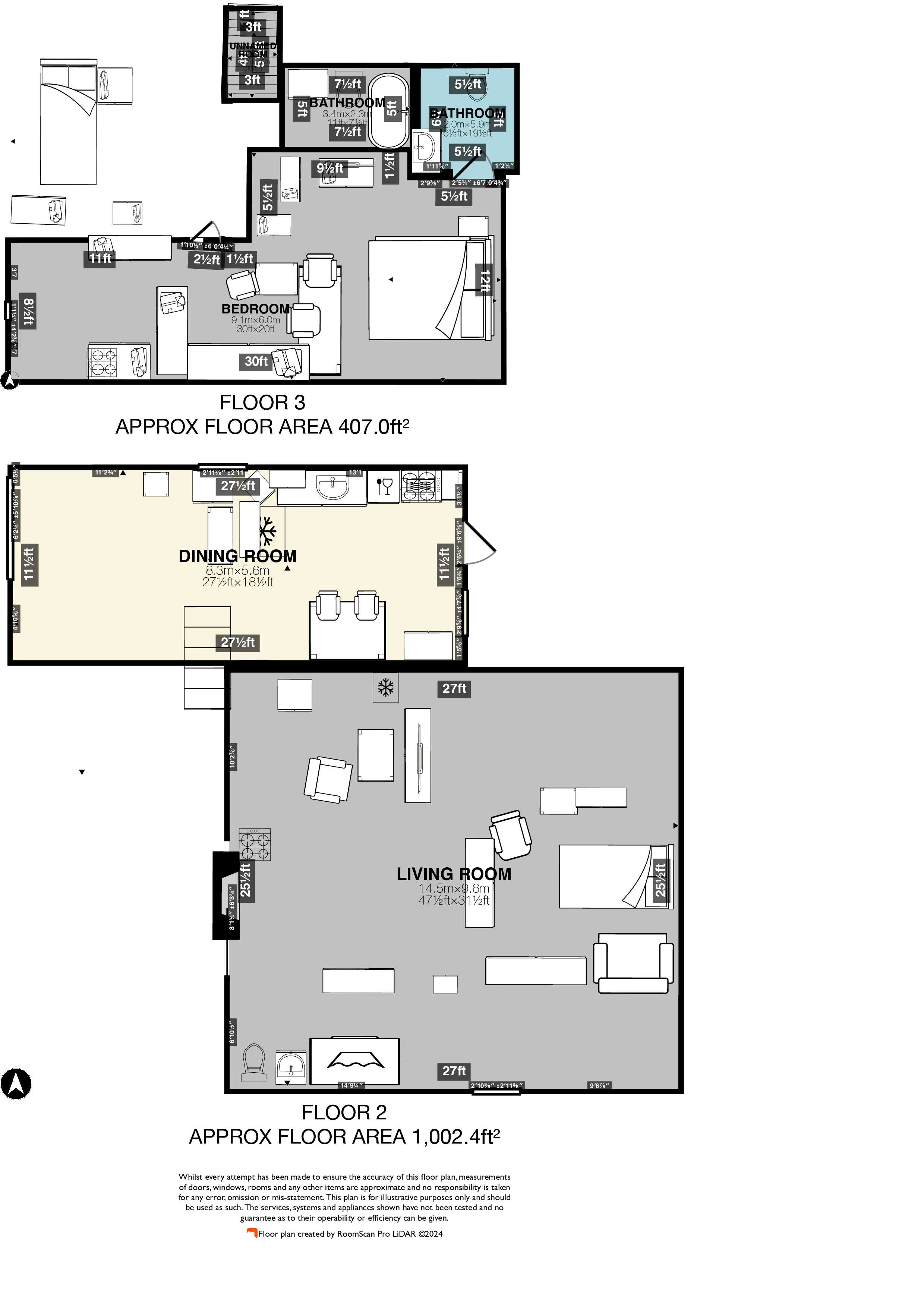

3D Walkthrough & Layout

The 3D tour shows current, unedited condition and layout – including cosmetic issues. Roof, HVAC, and water heater are functioning; main work is flooring, paint, bathroom floor repair from a past small leak, and yard clean-up.

LiDAR Walkthrough Video

LiDAR scan walkthrough showing current property condition and layout.

Property Photos

Click any image to view full size. Photos show current condition and recent improvements.